DOING BUSINESS IN VANUATU

Vanuatu is politically stable and offers no direct taxes, exchange controls with minimum indirect taxes and fees. Policy reforms and measures to enhance the country's business environment is a top priority in the Government's agenda, making doing business in Vanuatu your best choice.

FACTS

New initiatives and essential reforms contributing to the overall regime of doing business in Vanuatu have been undertaken on a regular basis as part of the Government's commitment to improving the country’s business environment thereby enhancing its attractiveness for private investors and encouraging greater investment expansions to the rural areas of the country.

Business reforms

Vanuatu undertook 13 reforms to make business easier since 2009.Trade Portal

A platform that publishes all requirements for trade in goods, investment and immigration in Vanuatu.Single window portal

A platform that publishes all requirements for trade in goods, investment and immigration in Vanuatu.Online Company Registry

Having an online registry for company registration has significantly improved starting a business in Vanuatu.No capital requirement

Foreign investors are no loner required to pay affront the minimum capital requirement (of 5 million vatu – approximately US$50,000) for a new investment approval application.Economic zones

The Government supports and encourages the development of economic zones in its major islands.Trade policy framework

A live document that assesses the factors constraining Vanuatu’s trade competitiveness and proposes recommendations to address those constraints.Doing Business in Vanuatu: Vanuatu's Ecosystem

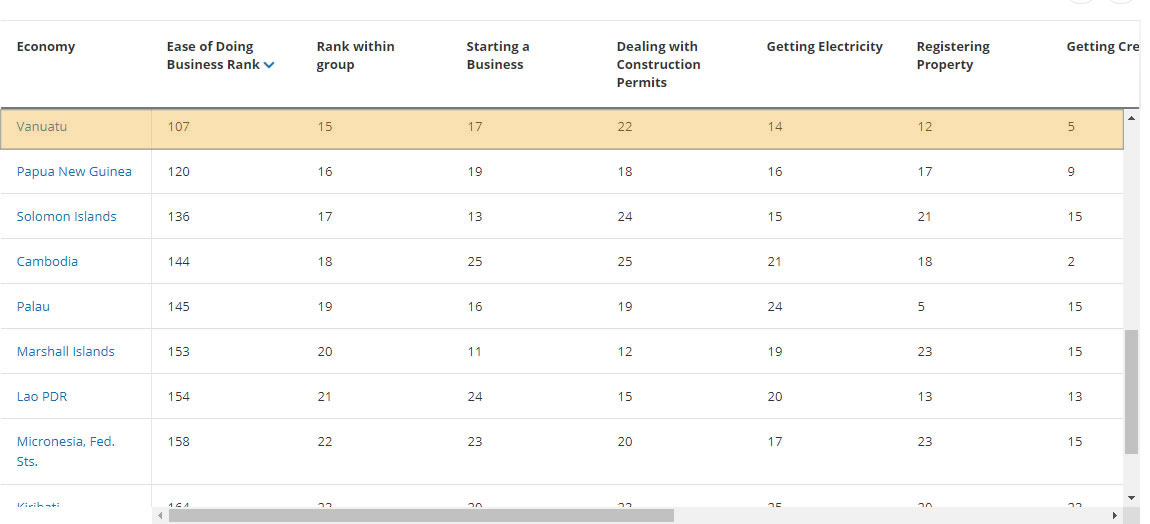

Ease of Doing Business Ranking

Doing business in Vanuatu by the World Bank latest report (2020) covering 190 economies on ease of doing business ranked Vanuatu in the 107th position. The report revealed Vanuatu made some overall improvement with a score of +0.4 percentage points attributed by:

- Getting Electricity - recording an improvement of +3.1 percentage points and

- Resolving Insolvency - recording an improvement of +0.3 percentage points

Overall, Vanuatu's doing business regulatory environment can be said to be more conducive than its neighbors in the region including PNG and Solomon islands and other economies such as Cambodia and Lao PDR.

Vanuatu through its Foreign Investment Promotion Agency is aggressively pursuing policy reviews and reforms aimed at improving the country's doing business ecosystem.

Government pro Private Sector Development

The Government views private sector investment as the primary engine to sustain higher levels of growth. As such, it continues to strengthen the foundations of the economy, maintaining an open business environment, diversify and enhance its links with rural areas and improve the business-enabling environment through ongoing efforts to ensure fair and transparent entry measures for direct foreign investment.

Open Business Environment

Vanuatu has always maintained an open business environment for business activities and commerce. Demonstration of this commitment has been its strong liberalized policy on free business enterprise that benefits both foreign and domestic owned businesses:

- No foreign ownership restrictions

- Free movement of capital, talent, goods and information

- English and French as official languages with English the preferred language for business and contracts

- Businesses are encouraged to expand to the rural areas of the country

- VAT - exemption - for businesses with annual turnover of less than VT4 M

Significant progress has been made by the Government in the area of the legal framework for companies. The Companies Act was passed in Parliament in 2012, making it easier for people to conduct business. The Registration of Business Names Act was also amended in 2015 to ensure that all companies in Vanuatu register their business names.

Strong Intellectual Property Protection

The Government of Vanuatu has specific policies and legal protection in place for intellectual property rights. The country’s intellectual property laws have been developed to reach the highest international standards to create a free and fair business environment. Visit the Vanuatu Intellectual Property Office to know more about their services.

Strengthening private / public sector relationships aimed at enhancing the country's business environment remain strong and positive. Leaders of both parties continue to work together to ensure that the state’s business climate remain favorable to companies and businesses of all sizes, including existing and potential ones. There is ongoing efforts in formulating new legislation and updating existing ones and proposing non-fiscal and marketplace initiatives such as land reform and targeted industry incentives.

Vanuatu Foreign Investment Promotion Act N0.25 of 2019

Vanuatu now has an updated investment law. The legislation is generally consistent with international good practice and introduces a number of improvements and developments that offers certainty and predictability to foreign investors and international companies intending to do business in Vanuatu.

The Vanuatu Foreign Investment Promotion Act N0.25 of 2019 offers:

- Openness to private sector investment including foreign investment

- Guarantees provided to private investors

- How foreign investment entry into the country is regulated

- Investment opportunities are more focused in sectors of national priority

- Reserved and restricted investment activities will be regularly revised

Reforms undertaken to date that contribute to improved Doing Business environment in Vanuatu

According to the World Bank DB2020, the Vanuatu Government has successfully achieved the following changes over the previous years:

- Starting a Business: Vanuatu made starting a business easier by removing registration requirements and digitizing the company register.

- Getting Credit: Vanuatu improved access to credit by passing a new law that allows secured creditors to realize their assets without being subject to priorities of other creditors.

- Protecting Minority Investors: Vanuatu strengthened minority investor protections by increasing shareholder rights and role in major corporate decisions and clarifying ownership and control structures.

- Resolving Insolvency: Vanuatu made resolving insolvency easier by strengthening and modernizing its legal framework in relation to liquidation and receivership proceedings.

- Registering Property: Vanuatu improved the quality of land administration by appointing a land ombudsman to deal with complaints relating to the land registry.

- Trading across Borders: Vanuatu reduced the border compliance time for importing by improving infrastructure at the port of Vila.

- Registering Property: Vanuatu made property transfers faster by digitizing its land registry system and hiring and training new staff.

- Getting Credit: Vanuatu improved access to credit information by establishing a private credit bureau.

- Starting a Business: Vanuatu made starting a business easier by reducing the time required for company registration at the Vanuatu Financial Services Commission and issuing provisional licenses at the Department of Customs.

- Registering Property: Vanuatu made registering property easier by computerizing the land registry.

- Trading across Borders: Vanuatu made trading across borders faster by upgrading Port-Vila’s wharf infrastructure, which increased the efficiency of port and terminal handling activities.

Given the excellent infrastructure Vanuatu has regards Internet, Communications and Technology (ICT), the Government has undertaken essential developments in the ICT industry. Recent reforms in the following areas have received positive praise both locally and internationally.

Vanuatu Trade Portal : aimed at Making trade, investment and immigration procedures more transparent, this platform publishes all requirements for trade in goods, investment and immigration in Vanuatu.

Vanuatu Single Window Project : Vanuatu is the first country in the Pacific to launch the Electronic Window Project (2019-2020), an online software system for evaluation and management of import and export certificates, license and permits. The single window will substantially reduce barriers to trade, reduce border clearance times and improve security of traded goods.

YOU MIGHT BE INTERESTED IN

Advanced Pacific Regional TiS

As a party to the Pacerplus Trade Agreement (PP+TA), Vanuatu has been actively participating in workshops, consultations and training conducted […]

Facilitating FDI expansion

Retention and expansion of existing foreign direct investments (FDIs) will be a key strategic focus for VFIPA in the new […]

VFIPA Aftercare is critical

Aftercare and Advocacy is an activity that the Vanuatu Foreign Investment Promotion Agency (VFIPA) will actively be focusing on in […]